Child Support Attorney in Irvine & Orange County

In Need of a Child Support Lawyer in Irvine & Orange County?

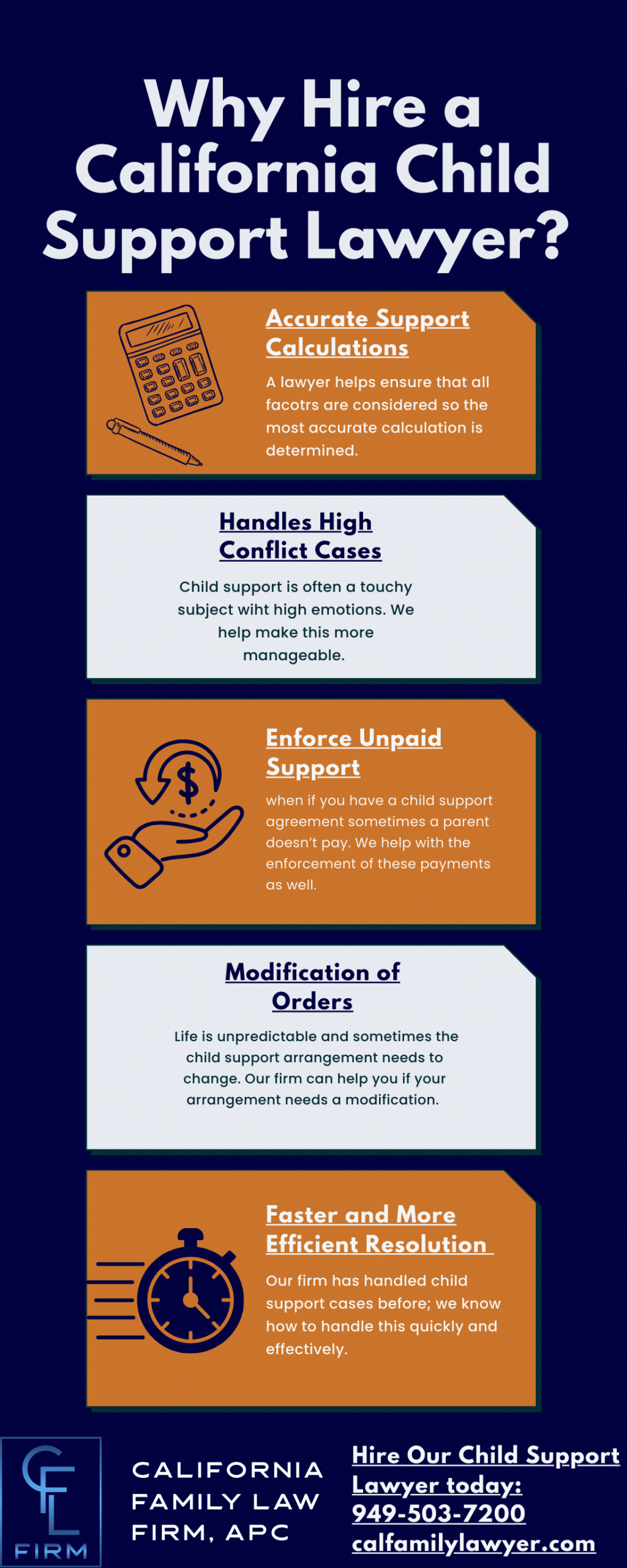

If you are looking for information regarding a child support case and your rights, we are here to help. To schedule a no pressure, confidential initial consultation to discuss your options with an experienced attorney at California Family Law Firm, a top child support law firm in Irvine & Orange County, call us at 949-503-7200 or send us a message in the form at the bottom of the page. California Family Law Firm represents residents of Southern California for legal services in all child support issues, including those related to initial child support orders, child support modification, child support enforcement, litigation regarding your or the other parent’s income, representation in legal matters related to hearings before the Department of Child Support Services (DCSS), Smith-Ostler calculations, and all other legal issues related to child support cases. We are experienced in the legal process of child support cases and can guide you through both drafting of an uncontested child support agreements high conflict contested child support actions, and everything in between. How a case proceeds, the amount of time it takes, and the cost depends on not only you, but also your child’s other parent. You can discuss all child support issues with your child support attorney during your initial consultation. You will undoubtedly have questions about the amount of child support you will receive or be ordered to pay, the timing and frequency of child support payments, additional child support add-ons for other expenses relating to extracurricular activities, school, healthcare, or childcare (daycare), and we are here to help. Oftentimes, the legal process can be frustrating and confusing. Child support legal proceedings may come at a time of uncertainty and sometimes instability. An experienced Irvine & Orange County child support lawyer at our firm will go over every step of your case, from drafting an initial letter to your child’s other parent advising of representation, to completing and filing all required Family Court forms and pleadings, to coordinating service of all required documents, to litigation or settlement of all issues. We will discuss child support calculation, how long a child support order will remain in effect, other expenses that can be added to child support, how to calculate monthly income when it is irregular, what happens in the even a parent refuses or is unable to work, and the next steps we can take when a parent is behind on their child support obligations.

Child Support Modification

Child support may be modified based upon a change in any of the factors used to calculate child support, as stated in Family Code section 4055, discussed above. Most commonly, this is when one party’s income changes, such as when they earn a raise, obtain a new job, or lose their job. Child support orders can include a requirement to notify the other parent when a party’s income changes, or penalties for failure to provide notice. If you are unsure if the other parent’s income has changed, Family Code section 3664 enables a party to send the form FL-396 to the other parent once every 12 months after a Judgment in the case has been issued in order to require them to disclose their current income. If the other parent fails to answer, then form FL-397 may be sent to their employer to obtain information related to the party’s income. If the employer fails to answer, then a subpoena may be issued to them after a motion is filed. If the other parent is in agreement to modify, a short Stipulation and Order can be easily drafted to update the amount of child support. However, to ensure that the Stipulation contains all of the legally required language, an experienced child support attorney in Irvine & Orange County should be retained. If the other parent does not agree to modify, then a motion for modification of child support must be filed with the Court, and a judge must issue orders in order to change the amount of child support in your order. Your Orange County child support lawyer will discuss your options with you and can tailor your legal request to the Court to address specific issues that have arisen in your case.

Hiring The Right Child Support Attorney For You

It is extremely important to choose the best representation possible when child support is at stake. Your child support lawyer will discuss your and the other parent’s incomes, the potential for imputation of income, the ability to enforce child support obligations, and many other factors in crafting your child support request to the Court, tailoring the pleadings to your unique situation and providing you the strong legal representation you deserve.

Child Support Calculation

Child support is calculated based upon a formula stated in Family Code section 4055. While the formula itself is rather complicated, a Irvine child support lawyer at California Family Law Firm can enter all of the relevant numbers into a calculator and give you an idea of what the child support order in your case may look like. The formula can be simplified into three primary factors: (1) your income, (2) the other parent’s income, and (3) the timeshare percentage each parent shares with the child or children. There are many secondary factors as well, such as health insurance costs, retirement deductions, mortgage interest, property taxes, and more, but the three primary factors can help to at least give clients a broad idea of what their child support order may be. The formula that Courts use in calculating child support is presumed to be the correct amount that the Court orders as child support with few exceptions, pursuant to Family Code section 4057. The most common exception is when one parent is not earning up to their ability. If the Court believes a parent is not earning up to their ability, they can impute income upon that parent, meaning treat that parent as if they are earning a certain income even when they are not. To impute income upon a parent, a Court must find that the parent has the ability and opportunity to earn the wage alleged by the other parent, as well as find that the imputation of income is in the child’s best interest. This usually occurs in the cases of one parent returning to the workforce after time as a stay at home parent, but can also occur when that party marries a new spouse who supports them, relies on other family to support them, or simply quits their job out of spite of their child support obligation. Family Code section 4053(a) states “A parent’s first and principal obligation is to support the parent’s minor children according to the parent’s circumstances and station in life.” Calculation of earning capacity can be potentially difficult to prove, and can include factors such as age, occupation, skills, education, health, background, work experience, and qualifications. It may also require a vocational evaluation of that parent. An Irvine & Orange County child support lawyer at our firm can walk you through your specific case circumstances, prepare all necessary Court pleadings, and provide the strong representation needed to give your case the best chance of success.

When Is Child Support Paid and For How Long

It often takes months for a hearing on child support to take place after the motion is filed, absent exceptional circumstances. For that reason, a child support order can be made retroactively to the filing date of the Petition pursuant to Family Code section 4009, or in the case of modification of an initial order, to the filing date of the motion to modify pursuant to Family Code section 3653. Oftentimes, a Court will make the order retroactive to the first day of the month following the filing. For example, if a Petition or motion to modify were filed on July 15th and the hearing is not until October 4th, the judge would likely make an order for child support for the months of August, September, October, and going forward. A child support order will often include either that payments are due in full on the first of the month, or one-half on the 1st and one-half on the 15th of the month. Child support orders include specific amounts for each child, although not equally. The younger child is assigned a higher amount of support. The number of children is an important factor in a child support order and is taken into account so that the parties do not have recalculate support when a child ages out. Child support is owed for a child until they reach both 18 years of age and graduate high school, or until they reach 19 years of age if they have not yet graduated at that time, pursuant to Family Code section 3901. Section 3901 also allows enforcement of an agreement between the parents to pay additional child support, such as for college or beyond, but does not require this unless the parties agree. Finally, the issue of child support does not have to be litigated. It can be settled. However, proper legal representation is vital, as there are certain orders that are unenforceable, such as waiving child support altogether, and certain mandatory provisions that must be included in a child support order.

Initial Child Support Orders

An order for child support is based upon the child support guidelines stated above, and can be made in several types of cases. A child support order can be made in a divorce case, a paternity (parentage) case where the parties were never married, a domestic violence restraining order, or even on a Petition of its own. In each of the above besides the domestic violence restraining order cases, a separate motion for support must be filed in order to obtain a hearing on the issue of child support. It is important to obtain legal representation as soon as possible so that you can properly address the issue of child support in your case and protect your rights. At the hearing, the Court will analyze each party’s income, as defined in Family Code section 4058, which includes a wide ranging definition of income. If a party is self-employed or has irregular income, then the Court will likely set a base amount of monthly child support, and an order for a percentage of any bonuses, overtime, or distributions the paying parent receives, called a Smith-Ostler order. The percentage of additional pay owed will vary depending upon the amount of additional income received. Upon identifying the incomes, tax circumstances, and deductions of each party, and based upon your child custody orders, the judge will make an order for a monthly amount of child support. However, child support can always be later modified, as discussed in the following section. If no child custody order exists, then the judge will base the timeshare percentage on the actual time each parent spends with the child. Child support is never taxable or tax deductible, but can often be used as income for consideration of applications related to housing rentals, mortgages, or loans/credit cards by the party receiving support. If the parents reach an agreement for child support, they do not have to base it upon the child support guidelines stated above, but the guideline calculation must be done regardless. If the amount agreed upon is above the guideline, then to modify the amount requires a showing of a change of circumstances. However, if the amount is below the guideline, then it may be modified up to the guideline amount at any time, upon the filing of a motion. When there is an order for child support made, the party ordered to receive support may file an Income Withholding Order (form FL-195) with the Court. Once the judge signs the Income Withholding Order, then it may be served upon the paying parent’s employer, where the amount of child support will be withheld from their wages, and sent to the Department of Child Support Services to be given directly to the receiving parent. If the paying parent does not have a spouse or other children to support, then up to 60% of their disposable wages may be withheld, no matter the actual amount of child support ordered. If they do have a spouse or other children they support, then up to 50% of their disposable wages may be withheld. If they are more than 12 weeks behind on child support, these amounts may be raised by an additional 5%. In order to ensure you preserve your claims for child support, proper legal assistance is a must in your family law matter. Whether you are a custodial parent attempting to obtain child support sufficient to meet your family’s needs, or a non-custodial parent attempting to ensure you are not overpaying support, a confidential consultation with a Irvine child support lawyer at California Family Law Firm is beneficial to being informed of your rights and resolving your case as quickly and affordably as possible.

Child Support Add-Ons

In addition to the amount of child support ordered by the Court, Family Code section 4062 states that there are two mandatory child support add-ons for additional child support: (1) Child care costs related to employment or to reasonably necessary education or training for employment skills, and (2) reasonable uninsured health care costs for the child. Practically, if you are using a daycare or babysitter for your children during your work hours or school hours (not for times you go out with friends) and obtain them at a reasonable rate, the other parent will be required to reimburse you for 50% of the cost. Additionally, if you have any health care costs (including dental) for the children after insurance pays their share, the other parent will likely be required to reimburse you for 50% of those costs. There are exceptions to the 50% rule, but they are rare. The rules for procedures for these types of reimbursements are found in Family Code section 4063, and can be more fully explained by an experienced Orange County child support attorney. There are other add-ons to child support that the court may order, such as educational expenses, special needs expenses, extracurricular costs, and travel expenses for visitations. These expenses can add up significantly, so it is important to ensure these are addressed with the Court if they are relevant in your case. Finally, Family Code section 3751 requires that the Court order that health insurance coverage be included in any order for child support. Specifically, section 3751 states in relevant part: “When an amount is set for current support, the court shall require that health insurance coverage for a supported child shall be maintained by either or both parents if that insurance is available at no cost or at a reasonable cost to the parent. Health insurance coverage shall be rebuttably presumed to be reasonable in cost if the cost to the responsible parent providing medical support does not exceed 5 percent of the parent’s gross income.”

What to do when the other parent does not pay child support as ordered?

If the other parent has failed to fully pay their child support order, the first step is to file an Income Withholding Order, as discussed above. When that form is served upon the paying parent’s employer, deductions for support may be removed directly from their wages as a wage garnishment and sent to the Department of Child Support Services for you. The second step is to file a motion for back child support (arrears). This can be done by filing a motion with a payment history declaration and attachment (forms FL-420 and FL-421), where the amounts alleged are stated on a monthly basis. At the hearing on this motion, the Court will consider any proof of payments filed by the other parent, the amounts of arrears owed, as well as statutory 10% annual interest owed on any arrears pursuant to Code of Civil Procedure section 685.010. These amounts can add up quickly. Alternatively, if the paying parent is more than 30 days delinquent in their child support obligation, Family Code section 4722 entitles a party to use form FL-485 to establish a 6% penalty per month, up to 72% of an unpaid amount of child support. For these purposes, child support includes not only the ordered amount of child support, but also any add-ons ordered by the Court. The FL-485 form puts the burden on the paying parent to file the motion themselves, or continue to be subject to these penalties. As an additional motion, a parent owed child support arrears may file a motion for contempt against the owing parent. This can result in community service, fines, and even jail time. It is a strong motivator for a party owing arrears to work out a payment plan with the party who is owed back child support. Family Code section 3557 also allows for collection of attorney’s fees in any action related to child support arrears or penalties, “upon determining (1) an award of attorney’s fees and cost under this section is appropriate, (2) there is a disparity in access to funds to retain counsel, and (3) one party is able to pay for legal representation for both parties.” If all of the above are established, an award for attorney’s fees is mandatory. Finally, collection of these amounts can be a significant concern. Obtaining an order for everything you are owed is one issue, but collecting those amounts can be an entirely different issue. Our law firm can help you obtain your orders in a concise Judgment that can be used as an additional wage garnishment, Writ of Execution (to collect from bank accounts), Abstract of Judgment (lien on property owned), or through forced sale of property or collection of funds through the paying party’s business. As seen above, falling behind on child support can have serious consequences, and collecting the amount owed can be complicated. You may be entitled to certain penalties, interest, and attorney’s fees. To ensure you collect what you are owed, contact our Irvine & Orange County child support attorney at California Family Law Firm to discuss your options.

What to do when you cannot afford to pay child support as ordered?

If you cannot afford to pay the full amount of your child support order, it is imperative you file a motion with the Court as soon as possible, since in most cases child support can only be modified retroactively to the filing date of your motion. Child support may need to be modified if you or the other parent have a change in income, timeshare, or other related factors. Paying child support often requires a change of lifestyle, as the state of California has established guideline amounts based upon income of the parties, and many have trouble adjusting to their new incomes after support is paid. However, it is vital that you do not fall behind on child support. If you fail to pay child support as ordered, the other party may file a motion for back child support (arrears) against you, by filing their motion with a payment history declaration and attachment (forms FL-420 and FL-421), where the amounts alleged are stated on a monthly basis. You will be asked to gather any proof of payments for amounts the other parent alleges you have failed to pay, which the Court will consider at the hearing. Additionally, the judge may order statutory 10% annual interest owed on any arrears pursuant to Code of Civil Procedure section 685.010. These amounts can add up quickly. Alternatively, if you are more than 30 days delinquent in your child support obligation, Family Code section 4722 entitles a party to use form FL-485 to establish a 6% penalty per month, up to 72% of an unpaid amount of child support. For these purposes, child support includes not only the ordered amount of child support, but also any add-ons ordered by the Court. The FL-485 form puts the burden on the paying parent to file the motion themselves, or continue to be subject to these penalties. It is important to file this motion quickly to avoid unnecessary penalties. As an additional motion, a parent owed child support arrears may file a motion for contempt against the owing parent. This can result in community service, fines, and even jail time. It is a strong motivator for a party owing arrears to work out a payment plan with the party who is owed back child support. Family Code section 3557 also allows for collection of attorney’s fees in any action for related to child support arrears or penalties, “upon determining (1) an award of attorney’s fees and cost under this section is appropriate, (2) there is a disparity in access to funds to retain counsel, and (3) one party is able to pay for legal representation for both parties.” If all of the above are established, an award for attorney’s fees is mandatory. Child support arrears cannot be discharged in bankruptcy and can follow you for the rest of your life. Child support owed can be deducted from future wages, tax refunds, and even social security, workers’ compensation, disability, or unemployment before it is paid to you. Your bank accounts can be liquidated and your property can be sold without your consent. The state may suspend your professional licenses and/or drivers license, the federal government can refuse to renew your passport, and you may even be ordered to serve jail time. As seen above, falling behind on child support can have serious consequences and significantly disrupt your life. You may owe certain penalties, interest, and attorney’s fees. However, oftentimes these amounts can be negotiated to a lower settlement in order to save all parties time and attorney’s fees. To protect your rights, contact a child support attorney in Irvine & Orange County at California Family Law Firm to discuss your options.

Contact Our Experienced Child Support Attorneys in Irvine & Orange County, CA Today

At California Family Law Firm, we have the years of experience required to successfully litigate your case. Our Irvine child support lawyers will help guide you through the often overwhelming legal process of a child support case to help achieve the orders and results that are uniquely tailored to your and your children’s best interests. We do this through a cost-effective strategy of addressing the most immediate legal issues in your case first, and then methodically working with you through each remaining step of your case. If you are looking for a child support attorney that can strongly represent your interests and protect your rights, who will help you fight back when needed but also be a voice of reason during settlement negotiations, who will be fully prepared for your Family Court hearings and trial, look no further than a child support lawyer at California Family Law Firm. Our law office is conveniently located in Irvine, although we serve those located throughout Orange County in Irvine, Newport Beach, Anaheim, Santa Ana, Huntington Beach, Garden Grove, Fullerton, Orange, Costa Mesa, Mission Viejo, Westminster, Lake Forest, Buena Park, Tustin, Yorba Linda, Laguna Niguel, San Clemente, La Habra, Fountain Valley, Aliso Viejo, Placentia, Cypress, Rancho Santa Margarita, Brea, Stanton, San Juan Capistrano, Dana Point, Laguna Hills, Seal Beach, Laguna Beach, Laguna Woods, La Palma, Los Alamitos, Villa Park, Anaheim Hills, and all surrounding areas. We also serve those in Los Angeles County, and Riverside County. Strong legal representation near you is not only important, but vital to your case. We are available to schedule a no pressure, confidential initial consultation to discuss your options. Call us at 949-503-7200 or send us a message in the form below to set up your consultation with an experienced family law child support attorney at California Family Law Firm. Disclaimer: The information above does not establish an attorney-client relationship and is for informational purposes only. It is not intended as legal advice. There are many factors that might influence or change advice specific to your case following a consultation. Contact California Family Law Firm at 949-503-7200 to speak with an experienced Irvine family law attorney in order to obtain legal advice specific to your individual case.

We Also Offer the Following Services:

- Divorce

- Paternity

- Child Custody

- Spousal Support

- Domestic Violence Restraining Orders

- Military Divorce

Family Law Case Testimonials

1) An attorney at California Family Law Firm negotiated a quick settlement for child support following filing of a domestic violence restraining order where the other party had the sole household earning ability and the client was a stay at home parent. A strongly worded letter was necessary to gain a Stipulation on the matter and save all parties time and attorney's fees litigating the issue. 2) A client retained an attorney with our office seeking information on his child support rights. We guided him through different scenarios and reached an agreement with the other parent for an amount of child support that everyone was satisfied with. After intense litigation over the amount of a client’s income, an attorney in our office prevailed in obtaining an order based upon our client’s actual earnings from his business, rather than the higher amount of earnings the other side sought with the Court. We used forensic accounting to support our argument and win the case. 3) Our office litigated a case where we successfully imputed income upon a party who refused to work, despite having the opportunity and ability to do so, after years of failing to work up to their ability and support their children.

4) Our attorneys have successfully negotiated favorable child support and spousal support orders that allow military service members to stay financially secure. 5) A parent who owned their own business with irregular earnings sought our office’s assistance in reaching settlement for a child support matter, resulting in an amount that they could afford to pay and that the other parent accepted. 6) An attorney with our office was retained by a client who was owed tens of thousands of dollars of back child support arrears. We successfully obtained enforcement orders that allowed collection of the full amount of child support owed, interest, penalties, and attorney’s fees from the owing party’s bank account, tax return, and a lien on a rental property they owned. At California Family Law Firm, our attorneys have litigated virtually every aspect of child support and realized success on every type of issue, from quick settlement of uncontested issues to calculation of complicated incomes to litigating contested enforcement matters.

Strong legal representation near you is not only important, but vital to your case. We are available to schedule a no pressure, confidential initial consultation to discuss your options by either phone, video, or in person.

949-503-7200 19200 Von Karman Avenue, Suite 454Irvine, CA 92612.